Key Highlights

- The Isle of Man presents a unique regulatory landscape that requires founders to build a robust compliance foundation from day one.

- Key regulatory bodies, including the Financial Services Authority, enforce strict regulatory requirements across multiple sectors.

- Specialized compliance services are available on the island to help navigate everything from initial licensing to ongoing monitoring.

- Core areas of focus include Anti-Money Laundering (AML), Counter-Terrorist Financing (CFT), and data protection (GDPR).

- Strategic partners provide governance and risk management experts to ensure your business meets its obligations while maintaining focus on growth.

- Sectors like fintech, e-gaming, and financial services have specific frameworks that demand expert regulatory consulting Isle of Man.

Introduction

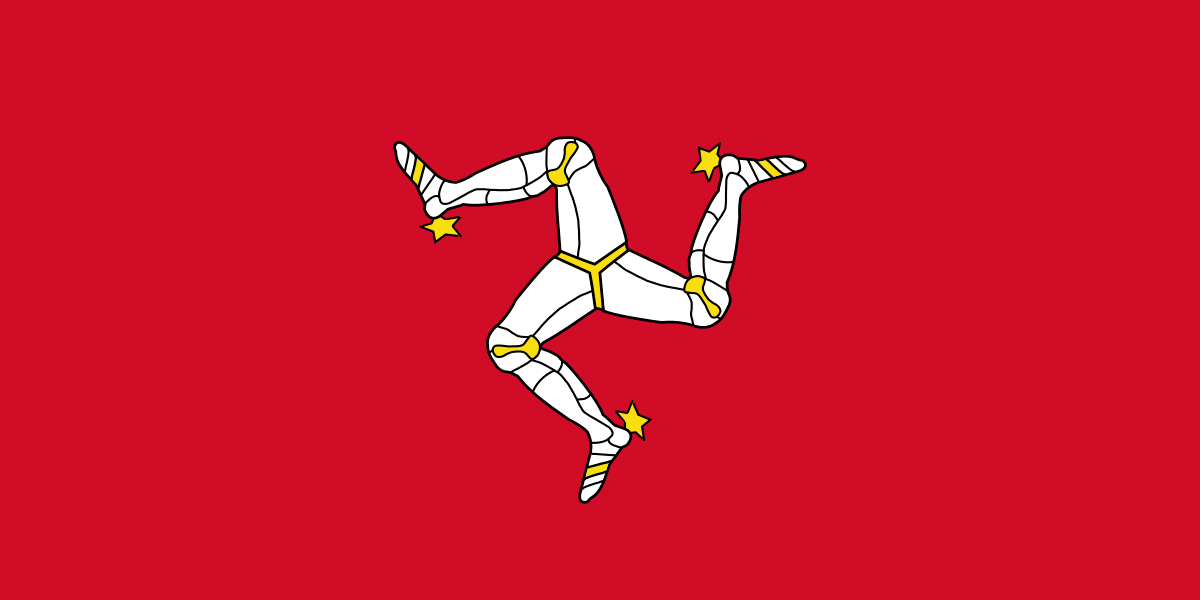

For founders building businesses in the Isle of Man, navigating the complex regulatory environment is a critical, non-negotiable task. The Isle of Man government has established a robust framework that demands precision and diligence. Understanding and integrating the right compliance services is not just about avoiding penalties; it is about building a resilient, scalable, and defensible operation. A strong compliance posture is the bedrock upon which sustainable growth is built, providing the stability needed to innovate and lead your market.

Understanding Isle of Man Compliance Landscape for Founders

The Isle of Man’s regulatory landscape is designed to uphold high international standards, creating a stable but demanding environment for businesses. For you as a founder, this means that meeting regulatory requirements is a fundamental aspect of your operational strategy from the very beginning. The regulatory framework is comprehensive, covering a wide range of activities.

To navigate this, a broad spectrum of compliance services is available, from initial license application support to developing bespoke risk frameworks and providing outsourced compliance officers. A dedicated team of experts can offer services for AML/CFT, data protection, economic substance reporting, and strategic risk management, ensuring your business has the infrastructure to thrive.

Regulatory Bodies and Key Compliance Requirements

The primary authorities enforcing the regulatory framework in the Isle of Man are the Financial Services Authority (FSA) and the Gambling Supervision Commission (GSC). These bodies are increasingly active in their supervision, conducting inspections, ordering remediation for breaches, and imposing significant fines for non-compliance. Their standards are aligned with global benchmarks, including those set by the Financial Action Task Force (FATF).

Ensuring you meet these regulatory requirements involves a proactive, not reactive, approach. Businesses can achieve this by embedding compliance into their core operations. This starts with a thorough understanding of the specific rules that apply to your sector and implementing robust internal policies and procedures.

The most effective way to guarantee compliance is to partner with governance and risk management experts. These partners can prepare your business for regulatory inspections, help you respond to findings, and ensure your internal controls are not only compliant but also operationally efficient. This turns compliance from a burden into a strategic advantage.

Navigating Initial Licenses and Registration Processes

Becoming a regulated entity in the Isle of Man begins with a complex and time-consuming registration process. Applying for a license under regulations like the Financial Services Act demands meticulous preparation of documents and a deep understanding of the FSA’s licensing policies. Any misstep can lead to delays or objections from regulators, stalling your go-to-market timeline.

The primary benefit of using Isle of Man compliance consultants is their ability to streamline this entire process. With expert guidance, you can be confident that your application is positioned for a smooth and positive outcome. Expert consultants provide more than just administrative support; they offer strategic legal advice and operational insight.

Their support includes:

- Drafting comprehensive application documents.

- Filing materials at the optimal time.

- Managing communications with regulators.

- Responding to any requests for additional information.

Core Sectors Requiring Compliance Expertise

While all businesses in the Isle of Man must adhere to certain regulations, several core sectors demand specialized compliance expertise due to the nature of their operations. These industries are foundational to the island’s economy and are therefore subject to heightened scrutiny. For any organisation in these fields, obtaining independent assurance is not just best practice; it is essential for survival and growth.

The sectors that most commonly require dedicated financial services compliance support and other professional services include banking, insurance, trust and corporate services, funds and investment management, e-gaming, and the rapidly growing fintech industry. Each of these has a unique set of rules that must be expertly managed.

Financial Services and Fund Management Compliance

Financial institutions and fund management firms operate at the heart of the Isle of Man’s regulated environment. These entities face strict rules on everything from capital adequacy and depositor protection to governance and anti-money laundering. The standards are rigorous, often reflecting the recommendations of the Financial Action Task Force (FATF). Expert compliance services are crucial for navigating fund establishment, re-organizations, and wind-downs while ensuring all material agreements and offering documents are compliant.

Isle of Man compliance services provide essential support for anti-money laundering (AML) regulations by developing and implementing robust AML/CFT policies and procedures. This includes conducting business risk assessments, stress-testing controls, and advising on notifications to regulators in the event of a breach, ensuring the firm remains in good standing.

Below is an overview of key compliance areas for these sectors.

|

Compliance Area |

Description |

|---|---|

|

Licensing & Authorization |

Guidance through the entire lifecycle, from establishment to wind-down. |

|

AML/CFT Framework |

Development of policies aligned with the Rule Book and FATF standards. |

|

Corporate Governance |

Translating regulations into practical guidance for Board-level decisions. |

|

Regulatory Reporting |

Assistance with required filings and communications with the FSA. |

Gaming, E-Gaming, and Fintech Regulatory Support

The Isle of Man is a global leader in gaming, e-gaming, and fintech, largely due to its forward-thinking yet robust approach to regulatory compliance. The Gambling Supervision Commission (GSC) has cultivated an environment that balances innovation with strong oversight, making the island a preferred jurisdiction. For founders in these dynamic sectors, compliance extends beyond licensing to include intellectual property, IT law, and data protection.

A key factor that makes the Isle of Man attractive is the availability of specialized advisors who have deep, practical experience. Many have even helped the government and regulators shape the very policies that govern these industries. This insider perspective is invaluable for navigating complex areas like software development contracts and cyber security measures.

Ultimately, the island provides a clear and respected regulatory framework, which gives businesses credibility on the global stage. Partnering with local experts ensures you can leverage this framework for a competitive advantage, rather than viewing it as an obstacle.

Foundational Compliance Services Offered in the Isle of Man

To meet the high bar set by regulators, a wide range of services is available to cover all aspects of compliance. These services are designed to be practical, scalable, and aligned with applicable international standards. Firms with significant experience offer solutions that allow you to focus on your core business, confident that your regulatory obligations are being managed effectively.

This support can range from one-off projects, like a business compliance audit Isle of Man, to fully outsourced solutions where a provider can fulfill key roles such as Compliance Officer or Data Protection Officer. The goal is to create a resilient compliance framework development that protects your organization and supports its growth objectives.

Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT)

Combating money laundering and terrorist financing is a top priority for Isle of Man regulators. The AML and CFT (Countering the Financing of Terrorism) legislation is stringent, requiring businesses to implement comprehensive systems to detect and deter illicit financial activity. A failure in this area can result in severe penalties and reputational damage, making it a critical focus for any founder.

AML and regulatory advisory Isle of Man services provide direct support by helping you understand and meet your obligations. These expert partners can identify potential breaches, implement remediation exercises, and advise on your internal policies to ensure they align with the latest rules issued by the Financial Services Authority.

Key AML/CFT support services include:

- Developing and stress-testing your Business Risk Assessment.

- Advising on policies for handling Politically Exposed Persons (PEPs).

- Implementing procedures for sanctions screening and compliance.

- Assisting with regulatory notifications and communications.

Economic Substance Rules and Tax Transparency Solutions

The Isle of Man’s economic substance legislation requires companies deriving income from specific activities to demonstrate a tangible presence and level of activity on the island. These rules are a key part of the global push for tax transparency and require every Isle of Man entity to assess whether they are in scope. The implications of non-compliance can include financial penalties and reputational harm.

As a member of the international community committed to these standards, the Isle of Man enforces these rules diligently. Compliance services can assist with international regulatory standards by providing cost-effective tools to determine if your business falls under the regime. They analyze your income streams and operational structure to provide a clear assessment.

Should your company be in scope, these partners help you navigate all aspects of compliance, from ensuring adequate local management to documenting core income-generating activities. If gaps are found, they can assist with remediation plans and negotiate with regulators on any potential penalties, strengthening your operational risk and governance consulting framework.

Strategic Risk Management Solutions for Growing Companies

Effective risk management is more than a compliance exercise; it is a strategic imperative for any growing organisation. Proactive founders and boards seek independent assurance that their company is protected from the growing complexity of risks. This is where strategic GRC (Governance, Risk, and Compliance) solutions become invaluable, transforming risk management from a defensive posture to a tool for confident decision-making.

Isle of Man compliance firms offer specific risk management solutions designed to identify, assess, and mitigate risks unique to your business. These services help develop and embed a compliant risk framework, stress-test controls, and provide a structured way to think about what matters most for your company’s future.

Custom Risk Assessments and Ongoing Monitoring

A one-time risk assessment is not enough in today’s dynamic regulatory environment. Ongoing monitoring is essential to ensure your business remains compliant and resilient. Custom assessments provide an objective review of your current state, identify gaps, and create an actionable roadmap for improvement and remediation. This is a foundational element of meeting your regulatory obligations.

A typical compliance monitoring service is a comprehensive solution designed to provide continuous Board reporting and compliance oversight. It translates complex regulations into practical guidance for each area of your business, ensuring that decisions are made with a clear view of associated risks. This creates a culture of compliance that permeates the entire organization.

These services often include:

- Annual effectiveness assessments of your compliance framework.

- Regular internal audits aligned with your corporate goals.

- Ongoing guidance through training and annual health checks.

- Support during periods of material change or crisis.

Data Protection, Privacy, and Cyber Security Measures

In a digital economy, data protection is a cornerstone of trust and a major compliance challenge. The Isle of Man has its own data protection laws that are broadly equivalent to GDPR, creating strict obligations for how businesses handle personal information. This includes managing subject access requests, ensuring confidentiality, and having robust policies for international data transfers. Navigating these requirements demands specialized expertise.

Compliance partners help by developing and implementing robust data protection frameworks tailored to your business needs. This includes creating comprehensive policies, procedures, and registers that simplify compliance and allow you to focus on growth with peace of mind. This is a crucial element of IT security and regulatory alignment.

In the event of a breach, these experts provide post-incident advice to manage the situation effectively. They can advise on your obligations regarding notifications to the Information Commissioner and assist in handling investigations or enforcement actions, protecting your business from both financial and reputational damage.

Conclusion

Navigating the complexities of compliance in the Isle of Man is essential for founders looking to establish a solid operational foundation. By understanding the regulatory landscape, identifying core compliance requirements, and leveraging specialized services, you can mitigate risks while fostering growth. Ensuring compliance not only protects your organization from potential liabilities but also enhances trust with stakeholders and clients. As you embark on this journey, consider partnering with experts who can provide tailored solutions and insights specific to your sector. If you’re ready to streamline your compliance processes and strengthen your business strategy, book a consultation with our team today.

Frequently Asked Questions

How do Isle of Man compliance consultants empower founder-led companies?

Isle of Man compliance consultants empower founders by providing a team of experts with significant experience in navigating complex regulatory obligations. Through a wide range of services, from license applications to outsourced compliance roles, they provide the professional services needed to build a resilient framework, allowing founders to focus on growth.

Can Isle of Man firms help with international regulatory obligations?

Yes, Isle of Man compliance firms are adept at helping a regulated entity meet international standards. Their guidance on applicable international standards, including FATF recommendations and economic substance rules, is rooted in deep jurisdictional and global expertise, often supported by strategic legal advice to ensure cross-border compliance is managed effectively.

What should founders consider when choosing a compliance partner?

Founders should look for a partner with a demonstrable wealth of experience and a strategic approach to GRC. Key considerations include their expertise in critical areas like data protection and AML, their ability to provide board-level assurance, and a commitment to confidentiality that aligns with your company’s values and operational needs.